Hey, let's talk car insurance. Part 1: What is car insurance? Well, I'll tell you. Car insurance protects you from a huge financial loss. Basically, you pay a monthly premium to your insurance company and in exchange, if you get into a wreck, the insurance company will help you cover your losses. Car insurance includes three different types of coverage. Number one is property, which will pay if your car is stolen or damaged. Two is liability, which pays for legal obligations to others for bodily injury or property damage. And number three is medical, which pays for hospital bills, rehabilitation, and sometimes lost wages or funeral expenses. Part 2: Money matters. So, how much coverage should you get? Well, that depends on different things, such as your car's value, whether you own the car outright, and how much in damages you could afford to cover out-of-pocket on your own. Naturally, your monthly premium will vary depending on your amount of coverage. For instance, it costs more to insure the Ecto-Mobile than it does to cover Mr. Bean's little mustard yellow car. That's the way of the world, kid, and don't you forget it. A very important note: just because you pay premiums, that doesn't mean you'll pay nothing when you get into a wreck. Most likely, you'll have something called a deductible. The deductible is the amount of money that you have to pay before your insurance starts kicking in. So, let's say you total your $5,000 car in a wreck and your deductible is $1,000. That means you are going to pay the first thousand dollars to get your car replaced, and your insurance will pay the remaining four thousand. In the good old US of A, nearly all states require that you have car insurance if you're going...

Award-winning PDF software

Do insurance companies report accidents to dmv california Form: What You Should Know

Lease-option purchases can be the best option for homeowners looking for a short-term rental or an opportunity to buy their own home. Estate Planning with a Rent-to-Own Mortgage — Real Estate Answers Dec 15, 2025 — This article tells you how to determine if you will need a second mortgage to pay your down payment and any other payments. Also, it tells you which states Rent-to-Own Property Ownership Guide — Landlord & Tenant Dec 20, 2025 — If you're looking to buy a new home, rent-to-own property ownership is your best bet. But how do you get started? Find out here ... Buy Rent-to-Own Property to Rent — Homes for Rent 2018 Guide to Rent-to-Own Lenders and Rental Agencies Oct 14, 2025 — If you are considering a rent-to-own home financing option, check out this 2025 guide to rental car, loan and home lease providers. ... Lease-Options Mortgage — Mortgage360 Nov 30, 2025 – We have made it easy to access all the tools you need to make your next mortgage decision easier ... The Complete Guide to Rent-to-Own Homes for Sale — SmartAsset Nov 15, 2025 — The complete guide to rent-to-own home financing to get homeownership financing for your next house. Learn how to ... Rent-to-Own Guide — Real Estate Answers Nov 25, 2025 — This guide covers everything you need to know to start your own real estate investment ... The Complete Guide to Rent-to-Own Lenders and Rental Agencies — RealtyTrac Nov 27, 2025 — There's a number of different ways to get a mortgage and rent a place to live, but the two most common are as follows:1) ... New Homes for Rent and Buy in Chicago — Curbed Dec 20, 2025 — This article focuses on apartments and single-family homes for rent in Chicago. It includes a map of rental housing areas ... Rent-to-Own Program — Banknote Oct 13, 2025 — The purpose of rent-to-own financing is to transfer the purchase and mortgage payments from the owner to the renter. What's more, it allows the owner to pay off the mortgage early ...

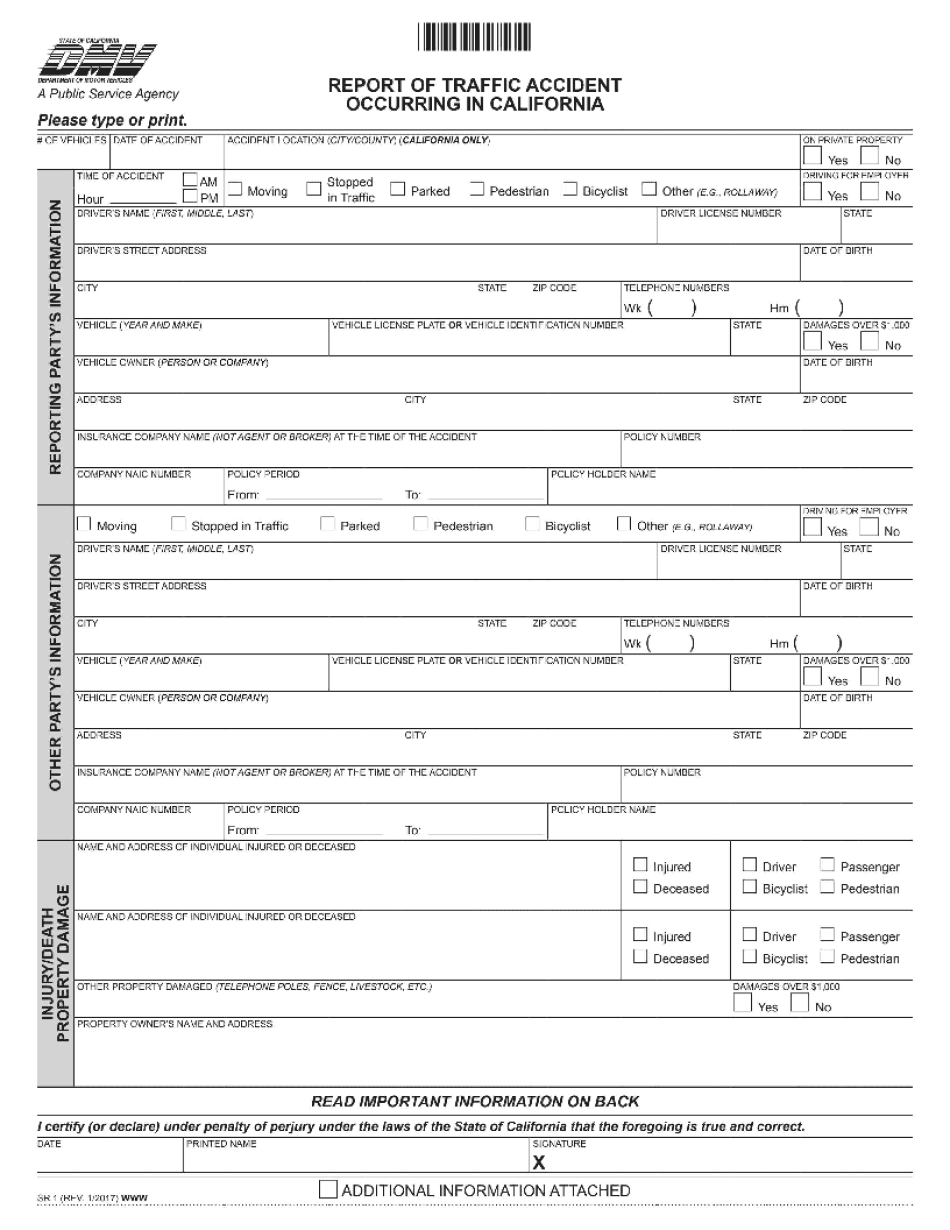

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2008-2025 Dmv Sr 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2008-2025 Dmv Sr 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2008-2025 Dmv Sr 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2008-2025 Dmv Sr 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Do insurance companies report accidents to dmv california