Award-winning PDF software

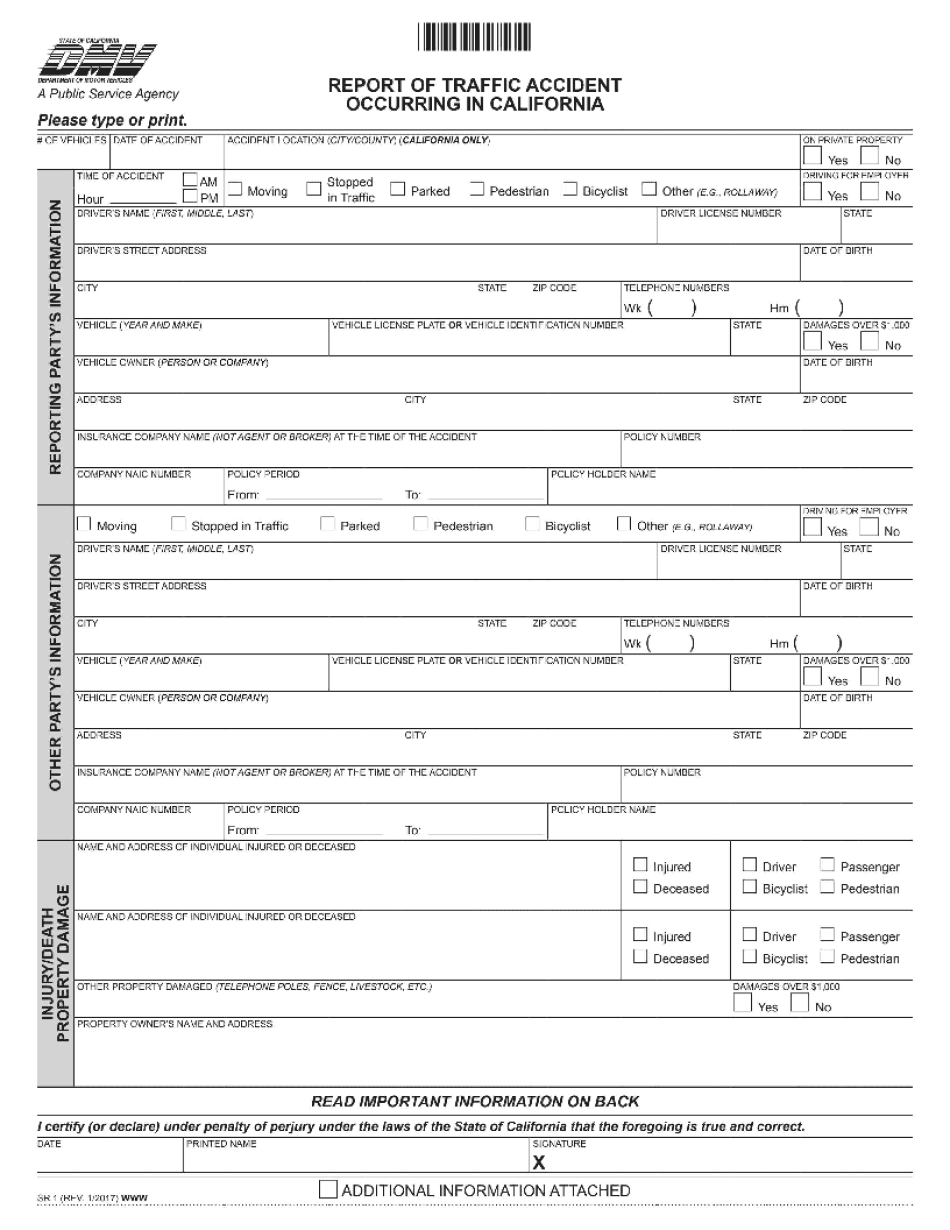

Does insurance company file Sr1? Form: What You Should Know

What constitutes a car accident can sometimes depend on the state in which it is occurring. To clarify this situation, we will explain some differences among the states in California, and in other state for which we do not have a specific version. If you have any questions regarding the reporting of car accidents in the state of California, please call one of our car accident attorneys at your expense: ) . California Driver's License What makes the California DMV SR-1 so important? As stated in the California Driver's License statute, the California SR-1 must be filed electronically in addition to any other report, including: California driver's license application form Other report form that the California DMV may accept for filing, including: California insurance agency form (If the car insurance is through an auto insurer, the insurance company's form must be filed electronically as well and is considered part of the California SR-1, but the insurance company does not have to file it) When a car accident happens in California, whether this accident resulted in damage to the driver or the car (and not to any other person), the police, car insurance company, CHP officers, or any other police, CHP, or insurance representative will get a copy of the report and the DMV will obtain a copy that will be mailed to the registered owner of the vehicle. California, How Does Accident Reporting Work in California? If a vehicle is damaged in a California accident, the insurance company, CHP, insurance agent, or law enforcement agency will file a report of these accidents with the DMV. The only exceptions is if: There was no property loss All minor cosmetic damage and none of the major damage to the vehicle was sustained beyond that sustained in the accident The car involved in the accident is reported to be a “California used car” In addition the following cases may or may not be subject of accident reporting: Any accident caused by the uninsured, under insured, or misrepresented driver Any accident caused by an auto collision (or a collision resulting in a fatality or serious injury) that was reported but not filed within 30 days before the accident.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2008-2025 Dmv Sr 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2008-2025 Dmv Sr 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2008-2025 Dmv Sr 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2008-2025 Dmv Sr 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.