Hi, I'm Sally Morin, a personal injury attorney in San Francisco. I'm here to discuss the statute of limitations in personal injury cases in California. First of all, a statute of limitations is a defined time period within which you must either settle your case or file a lawsuit to protect your legal rights. In a typical personal injury case, such as an auto accident, bicycle accident, motorcycle accident, pedestrian accident, or slip-and-fall, you have two years from the date of the accident to settle your case or file a lawsuit in California. However, if your case involves a governmental entity, like a city or county, you are required to go through a claims process with that entity. You need to fill out a form on their website and submit it to them. They then have 45 days to respond to you. It's important to note that most of the time, they will reject your claim. From the date of the rejection, you have six months to file your lawsuit to protect your rights. In the case of medical malpractice, you have one year from the date of the incident or the date of discovering the incident to file a claim with the medical provider to safeguard your rights. The key aspect of the statute of limitations is to avoid waiting until the last moment before consulting with an attorney. Attorneys are often hesitant to take on cases that are close to the statute of limitations because it poses a significant liability. Instead, it is advisable to work on settling your case early or seek legal counsel well before the statute of limitations is approaching. Good luck with your case.

Award-winning PDF software

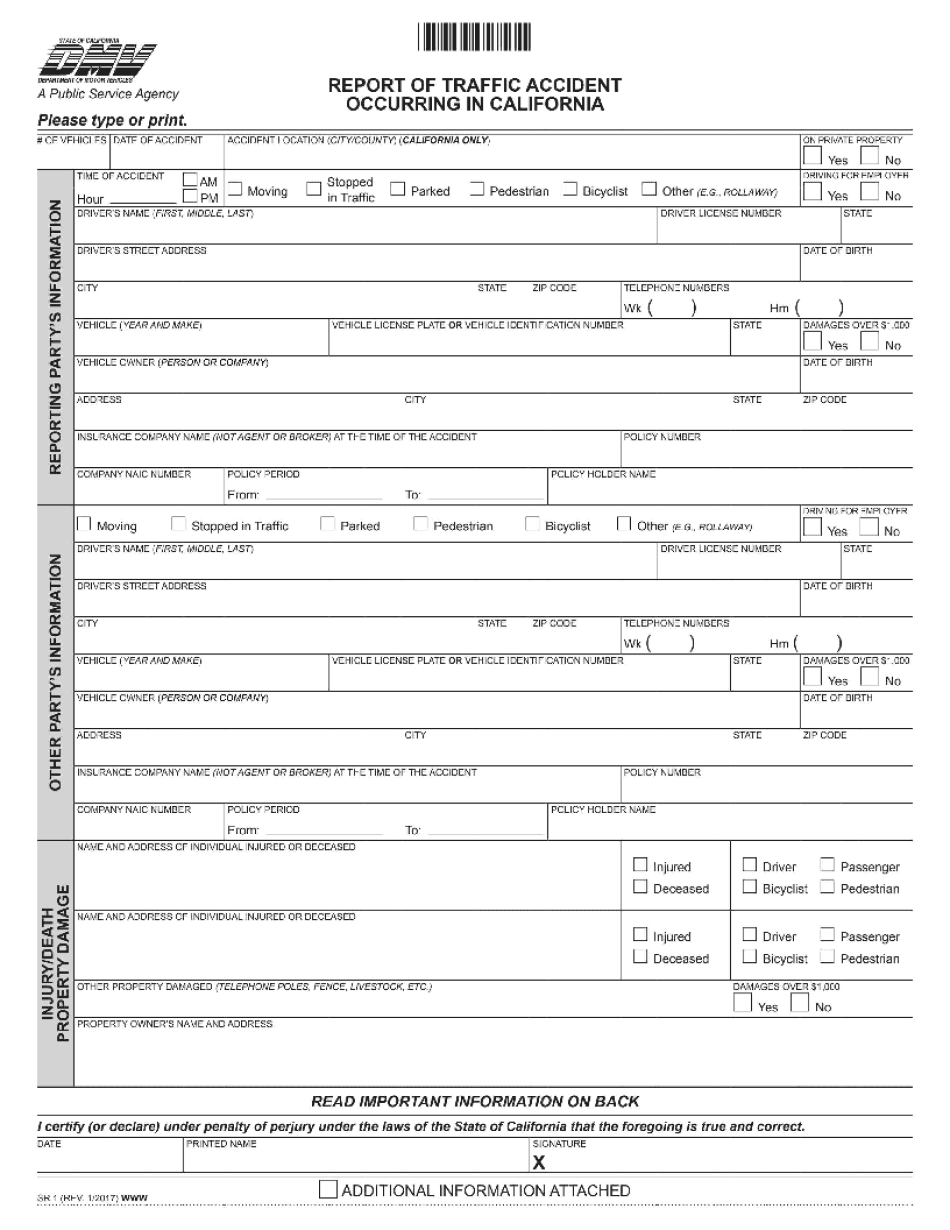

Penalty not filing Sr1 california Form: What You Should Know

The California DMV will still consider the SR-1 reports even if they don't follow the reporting requirements. How to File SR 1 Reports with the California DMV You need to fill out the form online via the DMV website, you must also keep it as evidence of your accident. Informational Page on the DMV Filing a Report of Traffic Accident You'll need: A completed and signed (and notarized) SR-1 report of the accident to file. California Vehicle Code 4907.7(a) : This states that an accident report: “May be reported as soon as practicable, which may be the report required by Section 2 of Bill Number SB 489, or by the first class mail. The report shall be considered the official traffic accident report of the driver involved, unless an emergency occurs, such as a fire or a sudden stop or accident, in which case it shall be considered only as a traffic accident report at the request of the Chief of the County Emergency Service Department.” California Vehicle Code 485 .5(a): An accident report must include the following information: State of the accident and the traffic report number on the report (for an SR-1 report) Vehicle Information (including: make, model, year, color, and license plate number) Accident location, as specified by the State Traffic Commission. Vehicle type and type identifier. (See Table 2.) Location of the person at the time of the accident. Whether an occupant of the vehicle was injured, killed, or trapped by debris, or was a pedestrian. Whether a crime was committed. Where the damage to vehicles or property was assessed. Whether you are driving the vehicle. Description of the accident. Description of the injuries to the driver. Any other information or details that would enable the Department to determine who was at fault. (See Table 3.) Table 3: California Traffic Accident Identification Records Vehicle type description Vehicle information description Vehicle type identifier Vehicle type identification number Injuries to the driver Victim Injuries to anyone injured by vehicle or any other property Victim in collision Damage to an occupant of a vehicle Victim killed in accident NOTE: If no vehicle information is entered in your accident report, the DMV will automatically add information such as whether you drive the vehicle, your name, etc. It is important to record a copy of the accident report which will provide you with a record that you filed an SR 1 report and that you are still valid.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2008-2025 Dmv Sr 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2008-2025 Dmv Sr 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2008-2025 Dmv Sr 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2008-2025 Dmv Sr 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Penalty not filing Sr1 california