Hi, my name is Mario Rise. I'm a media buyer with Freeway Insurance. Today, we're going to be talking about SR22 insurance - when do you need it, how do you get it, and what exactly is an SR-22? First off, an SR-22 is a legal document required by the DMV when your license is suspended. If you have outstanding tickets or maybe got a ticket for a DUI, the DMV will require you to get an SR-22. This document allows your license to be reinstated on a restricted basis. We'll get into the restrictions in a little bit. When you buy liability insurance, the SR-22 comes with it, and it is electronically filed by the insurance company. Once you have the SR-22, it means that you can get your license reinstated on a restricted basis. This restriction usually allows you to drive from work to home and from home back to work. It is crucial to keep your monthly payments up to date on an SR-22. If you miss one payment, your policy and SR-22 insurance will be canceled, and your license will be resuspended. You'll then have to go through the process all over again. So, it's essential to keep your payments up to date with your SR-22 insurance, follow the guidelines stated by the California DMV, and only drive from home to work. You cannot be anywhere else other than commuting between home and work. If you happen to be pulled over by a police officer, they will question you about your SR-22, where you are going, where you are coming from, and what happened with your SR-22. To summarize, keep your policy payments up to date with your SR-22, follow the guidelines, and only drive from home to work. If you do all this, everything should be simple. Thank you for listening. -Mario...

Award-winning PDF software

Sr 22 Form: What You Should Know

An SR-22 is not just a certificate of insurance; it is a legal document by which an auto insurer can determine whether you have the minimum liability coverages which are required by law. Are there any exceptions to the SR-22? Yes. An SR-22 does not require the same amount of coverage as a policy. SR-22 — Insurance company — Financial responsibility — Who should submit it? An SR-22 certificate of financial responsibility can be approved by an auto insurance company, a car manufacturer, or a personal injury attorney. A car manufacturer may require a certificate from an auto insurer. A personal injury attorney may request it to establish whether a defendant has the financial responsibilities that arise pursuant to applicable state statutes. How can I get the SR-22? There is no one answer to this question. However, the Department of Insurance recommends that you complete the SR-22 process for several reasons. An SR-22 allows insurers to determine if you have the minimum coverage required in accordance with applicable state laws. You must also use this certificate to make certain insurance claims to reduce or eliminate insurance premiums that might not otherwise apply. A good place to begin is with your driver's license. Driver's license renewal information at DMV: How can I get the SR-22 and keep it for multiple years? There are two ways to keep your SR-22 on file. Option One: Receive an SR-22 certificate of financial responsibility. Keep it on file and keep it current at all times. Option Two: Pay the insurance company 25/month by direct deposit, by mail, or online. This fee is applied to your auto insurance policy and is separate from your SR-22 certificate of financial responsibility. You will receive a bill in the mail with your name on it indicating when you submitted, when you paid, and the amount of the premium paid. Keep on file with your Auto Insurance Company to have your SR-22 on file with your Auto Insurance Company for future payments. When will my SR-22 expire? The SR-22 will not expire after five (5) years. However, we recommend renewing your SR-22 before then because the insurance company will send you a renewal notice within a month of the initial certificate. What paperwork does the SR-22 certificate have to follow? Your SR-22 is sent to you via certified mail.

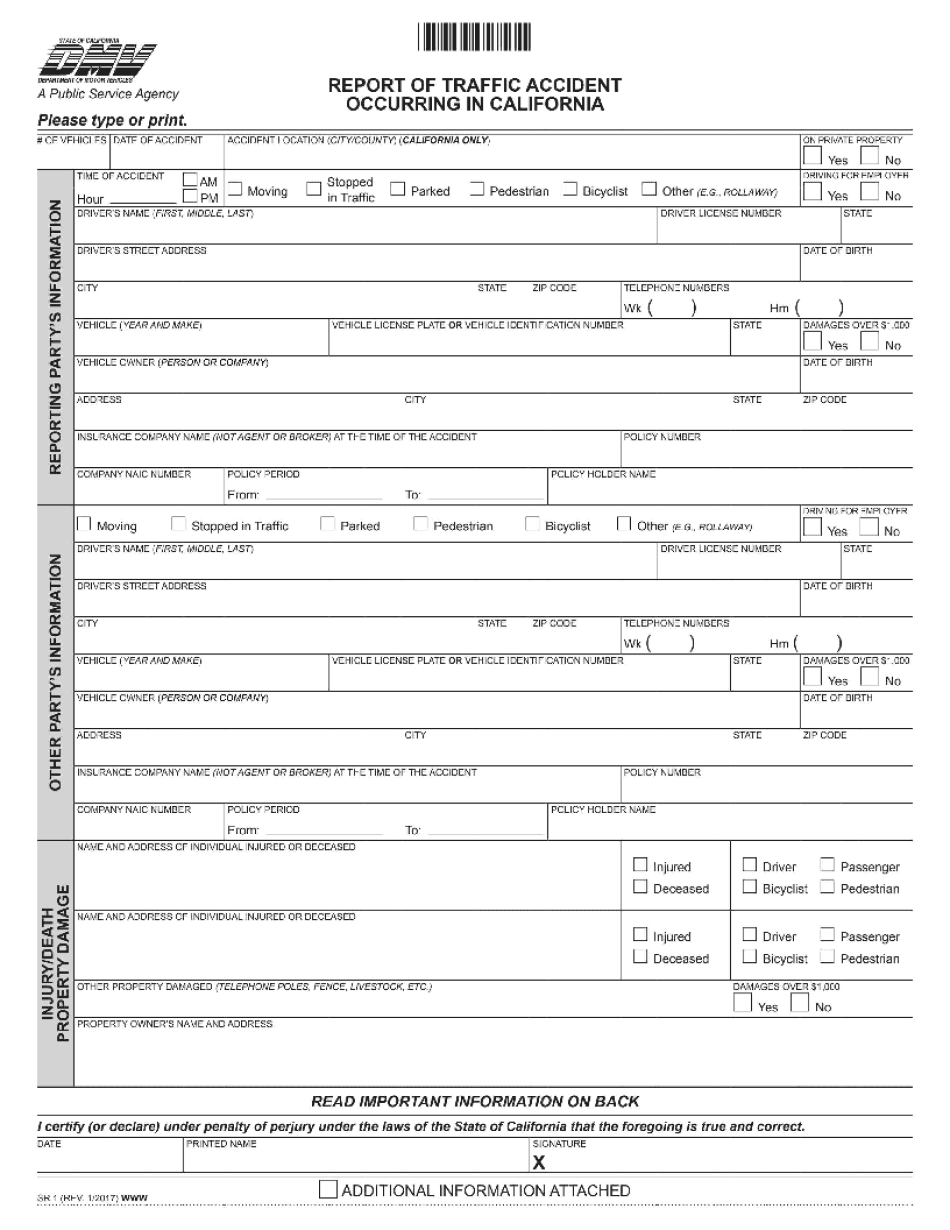

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2008-2025 Dmv Sr 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2008-2025 Dmv Sr 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2008-2025 Dmv Sr 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2008-2025 Dmv Sr 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sr 22