The police report says that the accident was your fault, but you know it wasn't. Hi, my name is Nicholas Warywoda, and I am with the law office of Parker Waichman. I would like to tell you about some of the cases that I have handled where clients have come to me with police reports blaming them for accidents that were not their fault. One particular case involved a woman who was injured in a car accident at an intersection. According to her, she had the green light and was driving down the road when she was struck by a fire truck that was crossing the intersection. The police arrived at the scene and took statements. However, when she received the police report a few days later, she was shocked to find that it blamed her for the accident. The report stated that she had failed to stop at a red light, even though she knew she had the green light. She approached our firm for help, and we immediately began an investigation. Unfortunately, we couldn't find any witnesses other than the firemen who were in the fire truck. We conducted depositions and proceeded to trial. During the trial, I questioned the police officer who had written the report. It turned out that he wasn't even present at the scene of the accident and had only relied on witness statements. Since the only witnesses were the firemen and my client was in an ambulance on her way to the hospital, she never had the chance to speak to the police officers. I focused my questioning on what was said to the police officer and whether he remembered the accident. Of course, he didn't because it had happened a couple of years earlier. In addition, I presented photographs of the damage to both vehicles, specifically...

Award-winning PDF software

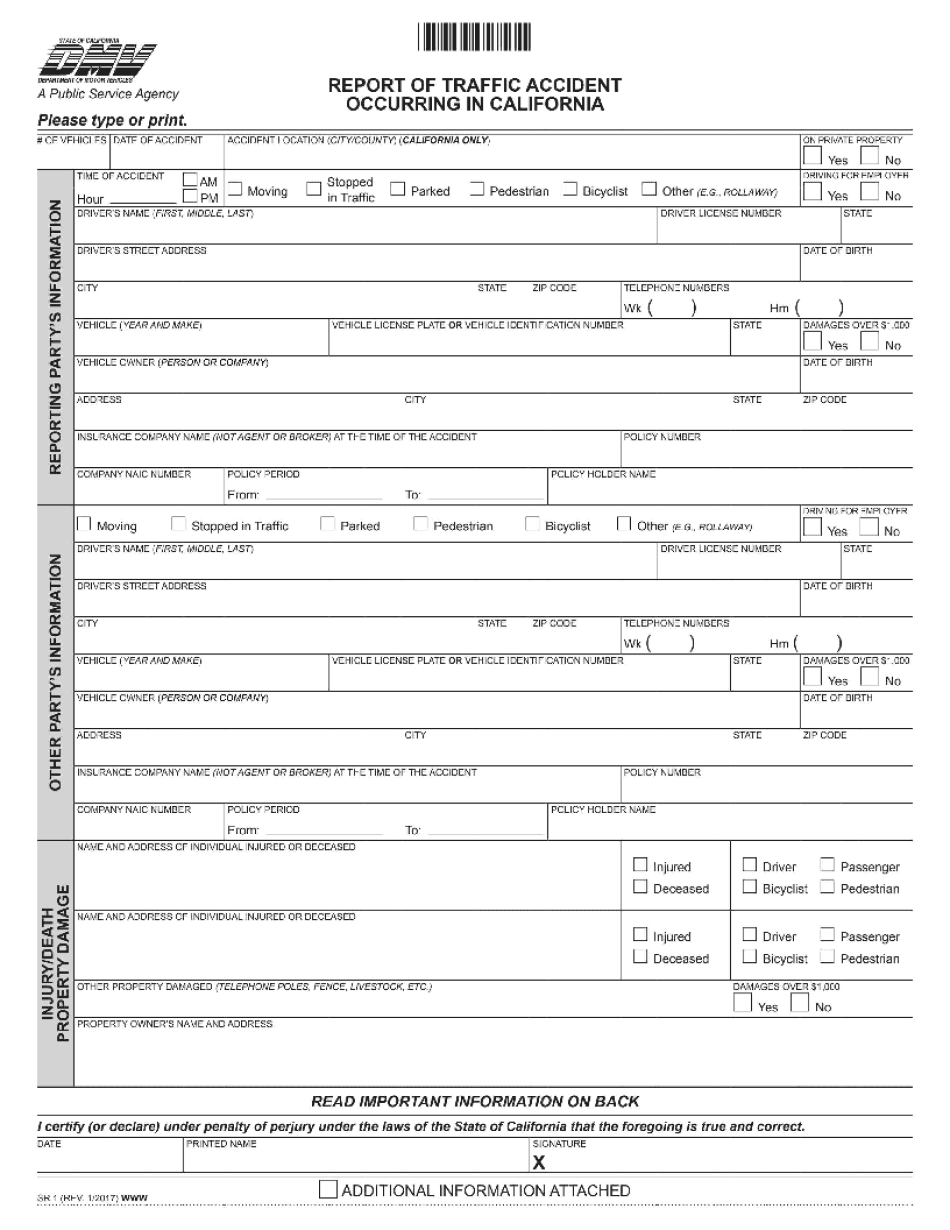

Do insurance companies report accidents to police Form: What You Should Know

A crash report that must be filed by a law enforcement agency. What the Police Report Must Say The police report must disclose the name of the owner and make or model of the car, the registration number of the car, The address of the accident and the names and addresses of the people involved. What to Do After a California Car Accident — California DMV — CA.gov The most important thing in the aftermath of a California car accident is to document all the information, make a good faith effort to get copies from witnesses and make copies for your own records. You must report the collision to the DMV and to your insurance carrier(s). You may also register a personal injury lawsuit against the other driver, your insurer and the person who caused the crash. In California, even if you are uninsured if the other driver hit your car, you could get compensation paid by an insurance company. This article from the New York Times states that an insured automobile owner whose car is damaged in a car accident may recover the following damages: One year's damages, plus three times the deductible plus 1,000 per person. An insurance company can also give you the names and addresses of people who contributed financially to your car accident. This can be very helpful in the future. If you lose or damage your car in a car accident, you should contact your insurance company as soon as possible. What to Report a Vehicle Accident in California Before you file a police report in California for any car accident, you should contact your local law enforcement agency to learn what information from a crash report is required.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2008-2025 Dmv Sr 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2008-2025 Dmv Sr 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2008-2025 Dmv Sr 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2008-2025 Dmv Sr 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Do insurance companies report accidents to police